RiverVest Venture Partners® is a leading venture capital firm building life science companies to address significant unmet needs of patients and deliver consistently strong results to investors.

YEARS

We Deliver Consistently

Strong Results to

Investors

- Lead financings, including founding companies, and build strong investor syndicates

- Focus on pre-money valuation and return potential

- Effectively manage risk, driving high hit rate

We Develop Products to

Address Significant

Unmet Medical Needs

- Invest in products (versus platforms) with a known path to clinical approval

- Place emphasis on demonstrating safety and efficacy in early clinical trials

- Aim to address pipeline needs of large pharmaceutical and medical device companies

- Rely on proven investment approaches that have driven past success, while introducing new strategies with significant value-creation potential

We Found and Guide Successful Companies

- Build high-performance teams, often ones we have worked with before, and boards

- Collaborate in developing company strategy and operating plans

- Structure financing terms to position companies for success

We Leverage a Unique

Innovation Network

- Find and cultivate compelling investment opportunities wherever they are

- Partner with a distinct network of entrepreneurs, investors, and key opinion leaders for deal flow

- Access global scientific, regulatory, clinical and reimbursement expertise for due diligence

- Provide geographic diversification for investors

We Maintain a Strong Partnership Built to Last

- Leverage extensive and complementary skills leading to strong investment decisions

- Follow a team approach to decision-making and portfolio company oversight

We Are RiverVest

Committed to doing business the right way to deliver the best outcomes for our stakeholders:

- Patients: We find and fund innovation to address significant unmet medical needs

- Entrepreneurs: We passionately believe in the teams we support and dedicate ourselves to helping them transform promising technologies into successful therapies

- Investors: We earn trust by building high-conviction portfolios, managing risk, and maximizing value

FUNDS

61 Investments and 41 Exits

/ HISTORY TIMELINE

RiverVest Venture Partners was founded in St. Louis in September 2000. With headquarters in St. Louis and offices in San Diego and Cleveland, RiverVest accesses forward-thinking research and clinical expertise at leading institutions across the country to fund and found biopharma and medical device companies that address significant unmet needs of patients and deliver consistently strong returns to investors.

Tom Melzer and Andy Craig explore feasibility of a St. Louis-based venture capital firm.

Jay Schmelter joins effort as co-founder, along with Melzer and Craig.

RiverVest is formed and raises Fund I. Fund I portfolio company investments lead to 16 commercial products treating patients to this day.

First two investments are made in Salient Surgical (Jay Schmelter co-founder) and CyDex Pharmaceuticals (now commercialized by Merck). Deals return a combined 3x on invested dollars. Commercial products from both companies have helped millions of patients.

Mike Berman joins RiverVest to advise on device investments and to provide a link to the robust innovation community in Israel.

RiverVest raises Fund II (top-quartile performer). John McKearn, Ph.D., and Niall O’Donnell, Ph.D., join and develop a successful biopharma strategy.

Portfolio company Cabrellis acquired by Pharmion, delivers 6x return.

RiverVest Cleveland office opens, with Karen Spilizewski joining, giving the fim improved access to deal flow and to excellent due diligence resources.

3×5 Special Opportunity Fund (joint venture with Portland-based Arnerich Massena) launches with a concentrated portfolio of later-stage life science and natural resource/infrastructure investments.

Founded by RiverVest, Fund II company Lutonix exits with 8.0x gross return, highest multiple to date.

RiverVest Fund III is raised, continuing same successful strategy as Fund II.

Lumena Pharmaceuticals, co-founded and seed-funded by RiverVest, acquired by Shire, delivers ~ $400 million to investors.

3×5 RiverVest Fund II launches with same strategy as 3×5 Special Opportunity Fund.

RiverVest San Diego office opens.

RiverVest's Archer Seed Fund launches with a strategy of investing in a small number of promising, very early-stage companies to position them for VC financing. Wugen and Scout Bio later receive follow-on funding in outside-led rounds, including from main RiverVest funds.

RiverVest Fund IV is raised (later ranks in top quartile DPI of 2018 vintage year funds).

Astra-Zeneca commercializes Lokelma™, the 25th product treating patients originated in a RiverVest portfolio company (ZS Pharma).

Portfolio company Allakos completes initial public offering, one of the most successful biotech IPOs in 2018 (laer results in 9x return for RiverVest).

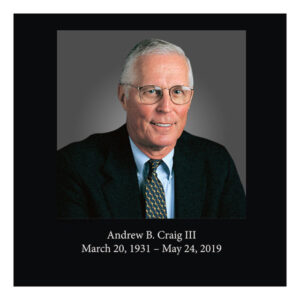

RiverVest co-founder Andy Craig passes away. Drawing on four decades of corporate and civic leadership and principled decision-making on behalf of stakeholders, Andy was instrumental in establishing a company ethos of integrity, discipline, teamwork, and trust that defines RiverVest to this day.

Derek Rapp and Isaac Zike join.

RiverVest celebrates 20 years investing in medical devices and biopharma.

Pascal Krotee joins.

RiverVest Fund V is raised with $275M in commitments.

Good Therapeutics and Standard Bariatrics, acquired by Roche and Teleflex, respectively. Both transactions close on September 27, marking the Firm's 21st and 22nd profitable exits.

RiverVest promotes three team members, positioning the firm well for the future: Karen Spilizewski and Isaac Zike, PhD to managing director, and Pascal Krotee PhD to principal.

Subscribe to our newsletter